ExxonMobil leveraging feedstock advantages; adding new capacity to support Asia

ExxonMobil Chemical, the world’s fourth-largest chemical company, continues to ensure its competitiveness in a low oil-price environment, according to a new report from IHS Inc. This competitiveness is due largely to the status of ExxonMobil Chemical as a world leader in proprietary technology, a geographically diversified portfolio, its access to advantaged feedstocks, its ability to upgrade co-products, and its strong refinery integration.

However, ExxonMobil Chemical’s product focus, similar to the chemical businesses of other oil and gas majors, is comparatively narrow, with relatively limited diversification. This, along with a decline in parent company ExxonMobil Corporation’s upstream earnings, may affect the company’s growth and competitive positioning, according to the new report, “IHS Chemical: ExxonMobil Chemical Competitive Company Analysis.”

ExxonMobil Corporation’s product portfolio ranges from oil and gas exploration, development and production to refining, fuels marketing, lubricants and specialties, and chemicals and it is the third-largest publicly traded, global oil and gas major with revenues of US$259 billion in 2015. Its earnings from the chemical segment accounted for more than 24% of the total company’s earnings in 2015.

Besides the competitive advantages, ExxonMobil Chemical’s feedstock diversity and flexibility, for ethylene, in particular, are the key elements driving margins. “However, the company does have limited product diversification in its propylene and benzene chains,” said Dave Witte, Senior Vice President of HIS/General Manager of IHS Chemical

He also added that the company continues to capitalise on US feedstock and energy costs, which are among the lowest in the world. “The company is expanding its Baytown (ethylene), Texas, and Mont Belvieu (PE), Texas, complexes, which are scheduled for completion in 2017. In addition, the company started its second Singapore petrochemical complex in 2013 to target the high-growth Asian market and is strategically investing in new elastomer capacity in both Singapore and the Middle East.”

One of the most significant investments for ExxonMobil is the expansion of its export-based position at Mont Belvieu, Texas. This ethylene – together with PE expansions -- will significantly expand the export company’s capabilities. Witte described ExxonMobil as a “logistics juggernaut,” focused on expanding its market reach through advanced logistical capabilities, and increasing commercial operations in growth markets such as the Asia Pacific region.

“Currently, ExxonMobil Chemical can supply the Asian market through its facilities in Singapore and China, but this US expansion will provide additional cost-effective options for exports to Asia and elsewhere,” Witte said, adding that it also makes the company a “very attractive candidate” for partnerships, particularly in Asia and the Middle East.

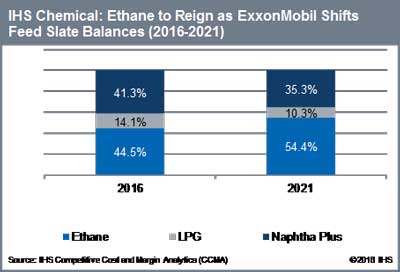

Ethylene is the largest-volume chemical produced worldwide, and in terms of manufacturing and market position, ExxonMobil Chemical resides at the top end of global producers and ranks third globally behind SABIC and Dow Chemical, respectively. The company has an ethylene production capacity (on a shareholder basis) of nearly 8.8 million metric tonnes (MMT) annually in 2016, and that number will expand to more than 10 MMT by 2021, the IHS report said.

It also intends to capture the benefits of integration (mostly around olefins and aromatics), which is also core to its strategy. One way the company does that, the IHS report noted, is to manufacture the bulk of its chemicals at facilities adjacent to its refineries, which enables the company to benefit from integrated operations and the sharing of services, maintenance and utilities.

Potential threats to the company’s continued growth could come in the form of three key challenges, Witte said. “If petrochemical prices decrease further, that will offset ExxonMobil’s US and Middle East feedstock advantages, which is significant. Additionally, if the company experiences constrained access to feedstock supplies in countries outside of the US, where the government or national oil companies control supplies, this could be a challenge.

However, Witte says the company’s biggest threat to growth may hinge on China’s economic slowdown, the potential implementation of protectionist measures, and the risks associated with geopolitical uncertainty in the Middle East.

(PRA)Copyright (c) 2016 www.plasticsandrubberasia.com. All rights reserved.