Fibre-reinforced plastics/composites are considered to be materials with enormous potential, including considerable potential for development in a wide variety of applications. They can be used, for instance, in the automotive industry, in construction, in aviation and in electronics. Many sectors of industry and areas of application are developing ever new uses for these versatile, young materials.

Since 2013 the trade association Composites Germany (www.composites-germany.de) has been gathering indicators on current and future developments in composites, based on a six-monthly member survey conducted by AVK, CFK Valley, CCeV and VDMA. The results of the fourth survey are now available:

- Positive assessment of the current economic situation

- Friendly investment climate

- Growth drivers in the automotive industry and CFP

- Slight dip in future expectations

Current economic situation – positive despite slight dip

Following trends in previous surveys, the current economic situation is seen as positive by the respondents. However, whereas in the last survey nearly 90% viewed the economic situation as “quite positive” or “very positive”, this share has gone down to just over two thirds of all respondents. The downturn was to be expected after the very high level in previous surveys. Once again, the situation is seen as particularly critical in Europe, whereas it is generally rated as better for Germany and on a global scale.

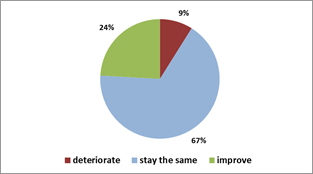

In the same context it is encouraging that assessments of the future economic situation are continuing to be so positive. About 90% of respondents believe that the economic situation will be the same or even better in the relevant regions (i.e. Germany, Europe and worldwide) over the next six months. (Illus. 1)

Illus. 1: Expected change in the economic climate around the world

Positive investment climate

The positive assessment of the general economic situation and the good future prospects are underpinned by several further factors. Nearly 30% of respondents are planning to recruit new staff in 2015, compared with only 10% who are planning to downsize their workforce. An equally good picture emerges for planned investments, as nearly two third of respondents are hoping to make investments this year.

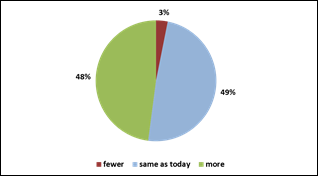

Likewise, a strong commitment to the composites market continues to be seen as worthwhile. Nearly half of all correspondents say they are hoping to step up their commitment to composites (Illus. 2).

Illus. 2: Future commitment to composites

CFP and automotive industry as growth drivers

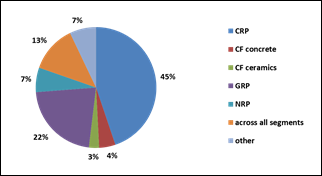

As before, the main impetus for growth in this survey is believed to come from CFP (carbon-fibre reinforced plastics). When asked which future growth drivers they perceived on the material side, nearly half of all respondents specified CFP (Illus. 3). The regional drivers in this segment are seen to be Germany and Asia.

For the first time the survey also covered the respondents’ assessment concerning future developments in different areas of application. The automotive and aviation industries are apparently expected by the composites industry to display the most positive development, followed by wind energy.

Illus. 3: Growth drivers in composites

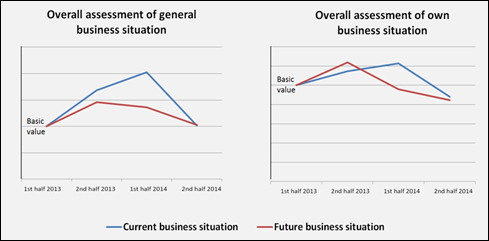

Composites Development Index – a downward trend, but still positive

Both the general economic situation and the companies’ own business situations are seen by respondents as somewhat more negative than in previous surveys (Illus. 4). However, it must be emphasised in this context that levels were extremely high in previous surveys. Yet despite this slight downturn, the assessment of the economic situation generally continues to be positive (see above).

Illus. 4: Composites Index “Business Situation”

(PRA)