Packaging Sector: A zero-waste future with sustainable packaging

The food packaging sector is stacking up to growing market demand for sustainable solutions and the global carbon neutral goals, adds Angelica Buan in this report.

Sustainable packaging answers three essential issues of our time: human health and safety, climate change and conservation of natural resources. Moreover, packaging innovation has shifted focus from mainly the product to both the product and the packaging. Packaging has to be safe, durable, visually appealing and environmental friendly.

On the other hand, plastic packaging has been vilified due to its purported contribution to waste pollution and carbon emissions, as highlighted in a 2019 report by the Centre for International Environmental Law (CIEL). It suggests that petroleum-based plastic lifecycle accounts for a huge amount of greenhouse gas emissions (GHG). The methods of disposing common plastics, either by landfilling, incinerating, or recycling, also have carbon footprints. Carbon emissions from plastics in 2015 amounted to almost 1.8 billion tonnes of CO2. By 2050, it has projected the amount of GHG emissions from plastics to reach 56 gigatonnes.

By this context, packaging that make use of fewer plastics and more of recycled materials; is recyclable or degradable and makes use of renewable resources and low-impact processes to produce can have a significant impact to curbing GHG levels. Thus, the packaging industry’s pivot to sustainable packaging will help to accelerate achieving a global carbon-neutral economy by 2050.

Consumers are salient to green packaging growth

The growing eco-awareness among consumers is also creating a profitable market for sustainable packaging. According to a 2020 green report by European metal packaging producer Trivium Packaging, undertaken by Boston Consulting Group, more than half of 15,620 consumers surveyed across the US, South America and Europe are taking packaging sustainability seriously. It is at the fore of their purchase decisions, the study revealed, adding that a majority of consumers are willing to pay extra for sustainable packaging.

In other words, sustainable packaging sells and the growing consumer demand for environmentalfriendly materials and products, especially ones that are recyclable, reusable, and degradable, are a main growth driver.

Thus, sustainable packaging is surging with research group Grand View Research expecting the value of the global green packaging market to reach nearly U$414 billion by 2027.

Compostable materials to meet sustainable packaging demand

Against the back of the growth of sustainable packaging, consumer goods and food and beverage sectors are switching to compostable materials for their packaging.

US-headquartered bioplastics producer of Ingeo PLA biopolymers, NatureWorks, in a recent partnership with Italian coffee handling and packaging company IMA Coffee, is expanding the market for its K-Cup compostable single-serve coffee pods in North America. The coffee pods and their components, including the film lidding and non-woven filters, are made from NatureWorks’ s 100% compostable Ingeo PLA.

NatureWorks intoned that single-serve coffee capsules are convenient, but consumers are put off by the packaging waste associated with a capsule. Compostable capsules, therefore, not only address consumer concerns on packaging waste but also recover the used coffee grounds, enabling their processing at a compost facility where they deliver valuable nutrients to the final compost, it said.

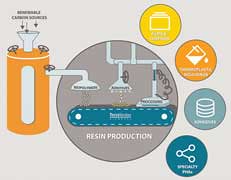

Similarly, Canadian performance bioplastics company TerraVerdae Bioworks has launched a new line of polyhydroxyalkanoate (PHA)-based resins for customer evaluations. Available in three versions for blown/cast films, injection moulding and thermoforming, these new resin formulations are not just biobased and biodegradable, but also have the performance properties for customers.

TerraVerdae’s PHA biopolymer technology can be used in a wide range of applications in the agri-food, packaging, personal care, forestry, coatings, adhesives and associated markets.

Meanwhile, New York-sited chemistry technology company Novomer has developed what it calls the industry’s lowest-cost polymerisation process to make compostable plastics.

Rinnovo, a PHA polymer, is synthesised from lactone monomers through Novomer’s proprietary catalyst system in high yields and high selectivity from readily available, cheap, sustainable feedstocks.

The compostable material, proven at demonstration scale, is produced in sample quantities at Novomer’s Innovation Centre and Novomer says it will start the construction of an 80,000-tonne facility in 2022.

Brands cutting down on plastic with rPET

Due to the growing demand for environmentallyfriendly packaging, manufacturers are adapting by using less plastics and developing thinner and lighter packaging. Brands, at their end, are reducing their plastic content in packaging.

For example, the PET widely used for food packaging and beverage bottles is now being replaced by recycled PET (rPET).

A 2017-published study by denkstatt GmbH for PET Recycling Team GmbH, a wholly owned subsidiary of Austrian plastic packaging producer Alpla, calculated the footprint of rPET and found that it has 79% lower carbon emissions compared to virgin material. Alpla has recently launched a reusable PET bottle for mineral water, called Pearl Bottle, for German purchasing cooperative Genossenschaft Deutscher Brunnen (GDB).

Plus, in a life cycle assessment of PET and glass mineral water bottles in Germany in 2019, Alpla found that the higher the proportion of recyclates in PET bottles, the lower the environmental impact of the packaging; and the lower the packaging weight (as per its filling volume). Compared to reusable glass bottles, reusable PET bottles perform better, Alpla said.

Elsewhere, major soft drink brands Coca-Cola and PepsiCo are also increasing the use of recycled content in their PET bottles.

Coca-Cola, which aims to make all its packaging recyclable by 2025, says it intends to use at least 50% recycled material in its packaging by 2030.

Recently, the company has rolled out 13.2- oz fully rPET bottles for some of its Coke brands in certain American states. The company says it will also be launching its other beverage brands repackaged in 100% rPET bottles.

Similarly, PepsiCo has also pledged to transition to using rPET bottles with a forecast of saving up to 70,000 tonnes/year of virgin plastics, and reducing per bottle carbon emissions by 40%. By 2022, it says it will package its beverage brands in 100% rPET bottles for nine markets in Europe.

Read full article...

(PRA) Subscribe to Get the Latest Updates from PRA Please click here

©2021 Plastics and Rubber Asia. All rights reserved.

©2020 Plastics and Rubber Asia. All rights reserved.

Home Terms & Conditions Privacy Policy Webmail Site Map About Us