Record-breaking year for BOPP film; Asia dominates increase

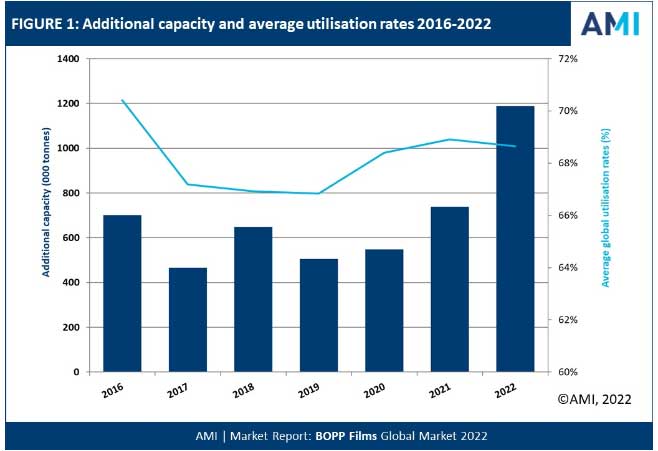

The BOPP film industry has undergone a transformational couple of years. BOPP film has proved to be covid-resilient, providing crucial hygienic product protection and delivery, particularly for the food industry. Furthermore, investment in BOPP capacity has also seen record levels, with Asia dominating the increase, particularly in India and China but with other smaller markets seeing rising investment.

Research firm AMI has published its tenth authoritative report mapping the global BOPP film industry. The report, published in June 2022, equips industry players and investors with a comprehensive understanding of the scale of industry development, market drivers and competitive pressures.

BOPP producers have been subject to extreme price volatility, going from record lows in 2020 to the historic highs of 2021, which came about due to a combination of diverse factors including inclement weather and a global container shortage, amongst other issues. Companies across the value chain have had to adapt to new ways of working to navigate the short-term pricing, which continues through 2022 with the crisis in Ukraine affecting costs of energy and raw materials.

There has been a shift in international trade dynamics of BOPP film, with protectionism, an increase in tariffs and a need to ensure security of supply with multiple and regional sourcing strategies. The report provides insight from conversations with suppliers across the value chain on likely future outcomes and company strategies to address the new market environment.

Demand for BOPP film soared in 2020 – the highest year-on-year rise since 2014, according to AMI’s historic data. This high demand was caused by the renewed importance of packaging films for food protection and hygiene, temporarily superseding anti-plastic sentiment in markets where this is prevalent. In addition, the covid pandemic accelerated the growing eCommerce retail trend, requiring increased production of tape products typically made with BOPP, for online delivery. AMI forecasts continued advancement of BOPP film demand to 2026, with global growth at around 4.1%/year to 2026, with marked differences in growth between different regions. Each region is examined separately to understand the various market drivers behind their supply, demand, and potential.

BOPP film capacity expansion is from both existing market players and new market entrants and has been driven by the opening up of the retail sector in emerging markets, growth in middle classes and associated consumer spending on packaged food and other goods. The global market report provides detailed qualitative insights into these investments around the world, and data on how they will affect utilisation rates each year as this new capacity comes on stream.

For the first time, AMI has included a chapter dedicated to BOPE in this report, due to the recent development of hybrid BOPP/BOPE lines, providing BOPP producers with the opportunity to broaden their product range and supply this emerging market in line with the emerging interest in mono-material and polyolefin packaging solutions.

The report quantifies capacity, production, and demand for BOPP film for food packaging and non-food applications as well as the different film types in each world region and highlights the development of the market for BOPP films over the past five years (2016-2021), how it is responding to global volatilities and the implications of upcoming investment, and how the market is likely to develop over the next five years to 2026.

(PRA)

Subscribe to Get the Latest Updates from PRA Please click here

©2022 Plastics and Rubber Asia. All rights reserved.

©2022 Plastics and Rubber Asia. All rights reserved.

Home Terms & Conditions Privacy Policy Webmail Site Map About Us