Biobased polyolefins slated for growth in next decade; Asia lead consumer

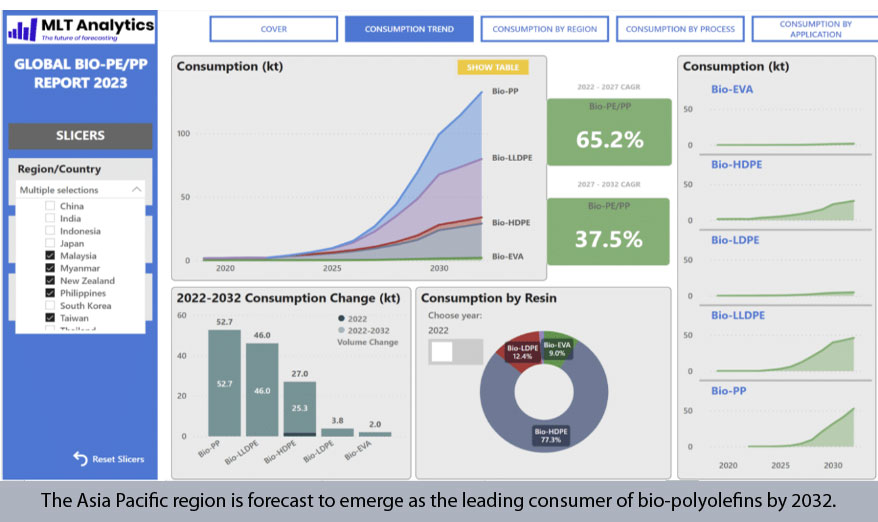

The global market for biobased polyolefins is forecast to multiply by a factor of more than 20 between 2022 and 2032, reaching a volume of more than 4.7 million tonnes according to a report released by MLT Analytics. It also adds that the Asia Pacific region is forecast to emerge as the leading consumer of bio-polyolefins by 2032.

This impressive growth is set to be fuelled by a variety of end-use applications, including existing mainstream bio-polyethylene applications such as extrusion coating, shopping bags, and blow-moulded containers, and emerging bio-polypropylene applications such as hygiene, housewares, and rigid and flexible packaging.

“2022 was a breakout year for bio-polyolefins in that we saw a notable diversification in the supplier base, with emerging suppliers developing and augmenting their commercial presence in the market, and adding to the dominant presence of incumbent producer Braskem,” said MLT Analytics CEO/co-founder Stephen Moore. “We also saw the bio-PP market more than triple in scale between 2021 and 2022 as mass balance-based polymer production kicked off in Europe and Japan,” he added.

Most global polyolefin suppliers have announced sustainable polyolefin targets, typically to be achieved by 2030, that involve a mixed slate of polymers derived from biobased, chemically-recycled, and mechanically-recycled feedstocks. And while the latter two routes may be preferred by some resin producers, brand owner and consumer pressures look like ensuring bio-based polyolefins will play a notable role in achieving sustainability targets.

The European Commission’s Packaging and Packaging Waste Directive (PPWD) in its current form is a potential complicating factor to market growth for bio-polyolefins according to MLT Analytics’s Moore.

“The Commission has essentially signalled its preference for C14 assay over mass balance as the preferred means of measuring bio content, and added that biobased plastics should target durable applications such as pipe and automotive, thereby functioning as carbon sinks. I don’t believe this is a stance that will be acceptable to bio-polyolefin suppliers given their investment in the mass balance approach.”

On the bio-polyolefin supply side, the main incumbent supplier, Brazilian polyolefins maker Braskem, is being joined by a stable of European, Japanese, and Korean suppliers, with Dow Chemical, also increasing its presence via production assets in Europe.

“Bio-polyolefins are major components of Korean and Japanese suppliers’ sustainability strategies, and they will have ready access to export-oriented markets in Asia Pacific,” said Moore. “In fact, by 2032, we expect the Asia Pacific region to overtake Europe in consumption of bio-polyolefins.”

Bio-polyolefin suppliers also need to ensure they can secure sufficient bio-feedstocks to polymerise their products for the market according to Moore. “Most bio-refineries focus on production of bio-fuels, with bio-naphtha being a lower priority by-product,” noted Moore.

(PRA)

Subscribe to Get the Latest Updates from PRA Please click here

©2023 Plastics and Rubber Asia. All rights reserved.

©2023 Plastics and Rubber Asia. All rights reserved.

Home Terms & Conditions Privacy Policy Webmail Site Map About Us