Low oil prices not a deterrent to bioplastics growth

The results of European Bioplastics’ annual market data update, presented recently at the 11th European Bioplastics Conference in Berlin, confirm a stable growth of the global bioplastics industry. “The market is predicted to grow by 50% over the coming years despite the low oil price,” says François de Bie, Chairman of European Bioplastics.

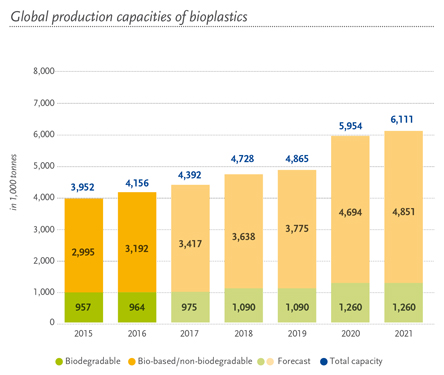

The global bioplastics production capacity is set to increase from around 4.2 million tonnes in 2016 to approximately 6.1 million tonnes in 2021. Packaging remains the largest fields of application for bioplastics with almost 40% (1.6 million tonnes) of the total bioplastics market in 2016. The data also confirms a decisive increase in the uptake of bioplastics materials in many other sectors, including consumer goods (22%, 0.9 million tonnes) and applications in the automotive and transport sector (14%, 0.6 million tonnes) and the construction and building sector (13%, 0.5 million tonnes), where technical performance polymers are being used.

“The data illustrates an important trend, driven by changing consumer demands, to make plastic products more resource efficient and to reduce greenhouse gas emissions and the dependency on fossil resources,” explains de Bie. “This trend is the result of substantial investments in research and development by the many innovative small and large companies that concentrate their strengths on the development of bio-based products designed with the circular economy in mind.”

Bio-based, non-biodegradable plastics, such as polyurethanes (PUR)(*1) and drop-in solutions, such as bio-based PE and bio-based PET, are the main drivers of this growth, with PUR making up around 40% and PET over 20% of the global bioplastics production capacities. More than 75% of the bioplastics production capacity worldwide in 2016 was bio-based, durable plastics. This share will increase to almost 80% in 2021. Production capacities of biodegradable plastics, such as PLA, PHA, and starch blends, are also growing steadily from around 0.9 million tonnes in 2016 to almost 1.3 million tonnes in 2021. PHA production will almost quadruple by 2021 compared to 2016, due to a ramp-up of capacities in Asia and the US and the start-up of the first PHA plant in Europe. With a view to regional capacity development, Asia will further expand its role as major production hub. In 2021, more than 45% of bioplastics will be produced in Asia. Around a quarter of the global bioplastics production capacity will be located in Europe.

Bioplastics are a growing, innovative industry that offers solutions for a sustainable plastics economy and that plays a key role in the transformation to a bio-based circular economy. Yet, despite these advantages, the data shows that the overall growth of the global bioplastics industry is currently being slowed down by the low oil prices and a lack of political support for the bio-based economy.

“A European policy framework that secures equal access to bio-based resources within the bioeconomy and that creates a level playing field for bio-based materials and conventional materials is of paramount importance,” says Hasso von Pogrell, Managing Director of European Bioplastics. “As is the acknowledgement of the facilitating role of compostable plastics and other innovative materials designed for circularity during their use and end-of-life for making waste stream management more efficient. We therefore urge EU legislators to consider the many benefits of bio-based materials in the implementation of the EU Circular Economy Package and to support initiatives to develop a global carbon-pricing mechanism to incorporate the external costs of climate change into product prices and that way enable the market penetration of greenhouse gas saving materials like bioplastics,” concludes von Pogrell.

The market data update 2016 has been compiled in cooperation with the research institute nova-Institute (Hürth, Germany). The data for the global production capacities of bioplastics is based on the market study “Bio-based Building Blocks and Polymers” by nova-Institute (2016), which looks at the entire scope of bio-based polymers, including bio-based thermosets such as epoxies, EPDM, and cellulose acetate (CA), which are not included in the scope of new economy bioplastics from European Bioplastics. For more information on the study and full market data report, please go to www.bio-based.eu/markets

Market data graphics are available for download on the EUBP website: http://www.european-bioplastics.org/news/multimedia-pictures-videos/

(*1) In 2016, bio-based polyurethanes (PUR) have been added to the scope of new economy bioplastics assessed in European Bioplastics’ annual market data research, in order to provide a more complete overview of the market.

(PRA)Copyright (c) 2016 www.plasticsandrubberasia.com. All rights reserved.