PRA Chinese

Rubber Journal Asia Injection Moulding Asia Energy, Oil & Gas Asia

VISIT OUR OTHER SITES:

PRA Chinese

Rubber Journal Asia

Injection Moulding Asia

Energy, Oil & Gas Asia

Chemical companies finding a formula to success

Also, download this story from the electronic issue here

A major driver of the world economy, the trillion-dollar chemical industry has stood the test of shifting global trends that are hinged on globalisation, systematic adoption of technologies, and sustainability, with more M&As on the horizon, says Angelica Buan in this report.

Reaching total revenues of more than US$4 trillion in 2016, the global chemicals industry is expected to grow further by 2021, according to the 2017 Global Chemicals Industry Almanac produced by UK-headquartered market research provider MarketLine.

Of the chemicals industry segments, petrochemicals are predicted to hit the US$885 billion mark by 2020, and lead the other key segments, in terms of market size. This will be on account of growing demand from end-user industries such as packaging, transportation, construction, plastics, and health care, according to Ernst & Young’s Global Chemicals Outlook 2030.

Meanwhile, increasing demand in end-user industries, as well as other key factors, ranging from pro-industry initiatives to new technologies, is also predicted to drive the speciality chemicals segment to reach US$470 billion; to be followed by the fertilisers and agrochemicals segments at US$195 billion.

The global economic environment has been volatile and, for industries that lack the agility to adopt, can be harsh. Unencumbered by an economic slowdown in major markets, the industry has re-strategised to sustain profitable growth by increasing capacities, realigning portfolio to boost core competencies, developing products and services geared towards sustainability, increasing deal activities, tapping other growth markets, and other like measures.

M&As: Joining forces to pursue growth and charter new markets

Mergers and acquisitions (M&As), as an enabler of strategic goals, work favourably in several ways. To cite a few, the supply chain synergies of the merged companies cushion them against the impact of feedstock fluctuations; as well, competition is reduced, “as the barriers to entry in the segment increases because of presence of big players”, according to the Ernst & Young report.

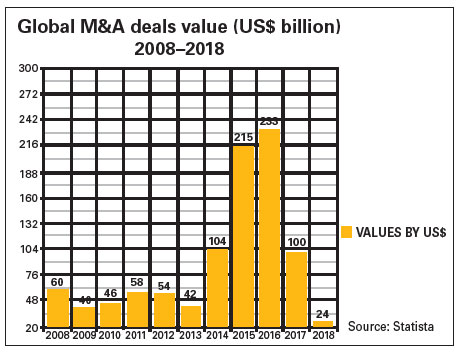

Through the years of securing profitability and market positioning, M&A activities continue to climb, although at a varied pace. Based on a ten-year data visualisation plotted by US-headquartered data provider Statista, 2016 had a record global M&A value of US$233 billion or up 288% from the 2008 value of US$60 billion; and up by 8.37% and 133% from the 2015 and 2017 values of US$215 billion and US$100 billion, respectively.

However, the Statista data showed a tapering off in values by 2018 to US$24 billion, sliding by 76% from a year ago.

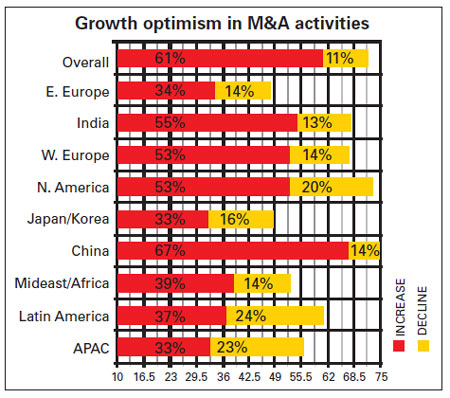

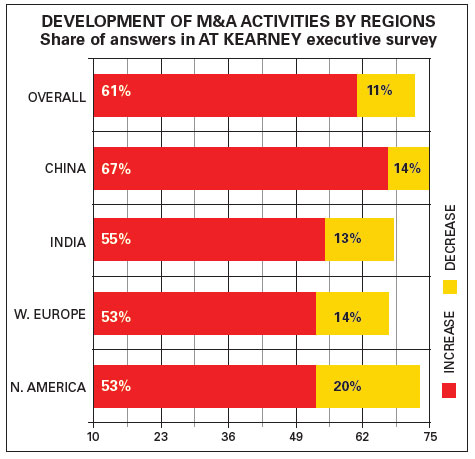

Nevertheless, according to a latest chemicals executive M&A survey released by US global management consulting firm AT Kearney, respondents expressed optimism of the uptrend in M&A activity continuing to 2018; with nearly two-thirds (61%) anticipating that the 2018 turn-out will be stronger than 2017.

What has set off this prospective trend is the recent mega-deal merger, specifically between chemical giants like Dow and DuPont to form the US$130-billion DowDupont firm, which targets to split the merged company into three businesses to focus on agriculture, materials science and speciality products in the first half of 2019. Other mega mergers include the German multinational pharmaceutical and life sciences company Bayer’s takeover of US agrochemical firm Monsanto in a US$63-billion deal; and the US$43-billion deal by Chinese chemicals company ChemChina to acquire Swiss biotechnology company Syngenta.

A significant few of respondents (11%), particularly those from Western Europe, opined the decline of M&A activity in 2018, mainly due to lack of “suitably sized targets, particularly after such a prolonged period of strong activity and escalating prices,” they added.

Meanwhile, 37% of respondents noted that “activist investors could limit the activity”, citing the foiled US$20 billion Clariant-Huntsman transaction, when activist investor White Tale Holdings, together with some other Clariant shareholders vetoed the merger.

Some respondents to the AT Kearney survey also opined why the Clariant-Hunstman deal, as well as the other similar mergers would likely not succeed.

For Clariant-Huntsman, respondents said the merged company would have had “an unclear leadership structure, and lacked synergy”; while on the other hand, “the action of activist shareholders blocked a potentially highly successful move from companies that have few other options”.

Emerging new opportunities

The failed bid by US paints and coatings producer PPG Industries to buy Dutch peer AkzoNobel in a US$29.5 billion deal was imputed to “how the PPG provoked AkzoNobel”. The latter had to resist the pressure from some shareholders to agree to the PPG takeover on alleged undervaluing of the business valuation and probable job layoffs.

Moving forward, the aborted mergers may not, after all, end on a bitter note. In a recent development, White Tale, which at the time had raised its stake to 25% or approximately US$2.4 billion to obtain a three-board seat representation, sold its stake to petrochemical company Sabic in January. Sabic is Clariant’s partner in the catalyst joint venture Scientific Design. This acquisition, claimed to deliver more value than the previous merger plan with Huntsman, now makes Sabic the largest Clariant shareholder.

More recently, Sabic itself has been in the limelight with an expected interest by the world’s largest oil company Saudi Aramco. On route to what will be the largest IPO in the world expected to happen next year, Saudi Aramco is picking up downstream businesses to diversify its portfolio into the petrochemical sector, in particular. It adds that it has been evaluating a number of acquisition opportunities, both local and global. Saudi Aramco further confirmed that it is engaged in “very early-stage discussions with the Public Investment Fund (PIF) regarding acquiring a strategic interest in Sabic by way of a private transaction”. It has no plans to acquire any publicly held shares, it said.

PIF, Saudi Arabia's top sovereign wealth fund, owns a 70% share in Sabic, which is the world's fourth largest petrochemicals company. Sabic has a market capitalisation of US$102.7 billion. In a separate statement, PIF also said that talks about a sale were in early stages. "There is a possibility that no agreement will be reached in relation to this potential transaction," it said.

State-owned Saudi Aramco wants to develop its downstream business as the government prepares to sell up to 5% of the world's largest oil producer in an IPO, possibly by next year. Boosting its petrochemicals portfolio further could help attract investors for the IPO.

In a similar vein, this transaction indicates the significance of state-owned companies like Sabic (which is also building a US$20 billion petrochemical facility with Saudi Aramco that is expected to start production by 2025); and ChemChina (which is anticipated to merge with another Chinese state-owned company, Sinochem, to create a US$120 billion chemicals company) in the rising M&A activities.

After PPG, AkzoNobel eyed a merger with US coatings company Axalta, which also did not progress. Currently, the Dutch company has finalised an agreement to acquire Brazilian firm Polinox, a producer of ketone peroxides used in the manufacture of polymers. AkzoNobel intoned that it expects the acquisition to expand its footprint in South America, and establish it as one of the region’s leading producers of curing systems for polyester thermoset resins. The company will invest to add capacity in its own site at Itupeva, Brazil, and transfer manufacturing there after the expansion is completed. The sale is expected to close in the fourth quarter of 2018.

Asia dominates the global chemical market share

The changing global economic landscape has dented the competitive advantage of Europe and the US, and thus re-routed manufacturing facilities and operations to emerging markets, including Asia.

Asia accounts for more than 60% of the market share of global chemicals and is expected to reach nearly 65% of the global market share in 2030, according to the Ernst & Young report. Asia is followed by the US and Europe, which are almost of equal footing, accounting for 20% and 19% market shares, respectively, according to The Business Research Company’s Chemicals Market Global Briefing 2017.

Overall contributing to Asia’s market dominance are its lower labour cost, the rising number of production facilities, and its growing population.

According to the AT Kearney Vision 2030 report, Asia, with almost 4 billion population or more than half the global population, is witnessing rapid urbanisation and increased consumption, thus driving demand for chemicals, largely used for basic needs such as in construction, clothing, and agriculture, to cite a few.

The two fastest growing chemicals markets in the region are China, which represents more than half of the region’s chemical sales; and India, which is slated to grow 9% annually from 2014 to clinch US$214 billion by 2019, as forecast in a Tata Strategic Management Group study.

China, mired in looming debt problems, slow GDP growth, and industrial overcapacity, is shifting to speciality chemicals, according to IHS Markit, and is expected to corner 6.5% growth per year from 2015-2020 to more than US$175 billion, outpacing North America to become the largest speciality chemical market.

Chemical trade in Asia, meanwhile, will get a boost as China reduces taxes with six other Asian trading partners, under the Asia Pacific Trade Agreement (AFTA) pact, formerly the Bangkok Agreement.

From 1 July this year, China has adjusted levies on imports covering 2,323 categories of commodities, including chemicals made in Bangladesh, India, Laos, South Korea and Sri Lanka.

The adjustment came after a new arrangement was reached during the fourth round of tariff concession negotiations among the six APTA members in January 2017.

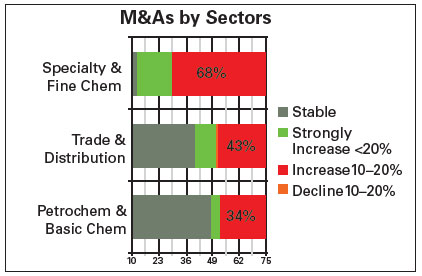

Given the hefty industry scenario in the region, M&A activities are also anticipated to expand. Respondents in the AT Kearney M&A survey are looking forward to brisk M&A activity in 2018, with some 67% hinging on China to be active during the year. China was the most active acquirer, followed by Thailand and India, the report finds.

About 55% of respondents projected the increase in activity happening in India, while Western Europe and North America will continue to score an increase in M&As, according to 53% of respondents.

The report finds that the shift in activity from developed to emerging markets has been an ongoing, but has been less significant the past few years.

In 2017, there was an increase in international acquisitions by emerging market acquirers, led primarily by China and partly by GCC (Gulf Cooperation Council) countries and Russia, in particular, value-wise. Almost 30% of the top ten deals in 2017 involved buyers from emerging markets; and developed market acquirers faced a stable trend in both domestic and international target transactions.

Achieving growth in the competitive chemicals industry is becoming more complex over the years. Companies, exhorting tools of growth such as M&As, are in hopes that with strengths and assets consolidated, weaknesses and liabilities are stamped out. Nevertheless, this is not always the case.

According to Ernst & Young, M&As come with postacquisition and joint venture integration issues.

There are also issues on competition from domestic producers in the case of cross-border deals, and cost challenges of divesting backward-integrated businesses.

In other words, there are no cut-and-dried long term successes. The global market is opening up growth opportunities for companies with the ability to innovate, to operate sustainably, and to utilise digital technologies that are available.

(PRA)Subscribe to Get the Latest Updates from PRA Please click here

Copyright (c) 2018 www.plasticsandrubberasia.com. All rights reserved.